The AtwoB Report - 3rd Quarter 2018

The Macro Backdrop. Still Looking Good.

The U.S economy just keeps chugging along. Last quarter, we remarked on the strength of both the US economy and corporate earnings picture. To be honest, over the ensuing three-months, not much has changed. The macro-economic and corporate backdrop still look good. So good in fact, that the normally reserved and banal outlook proffered by the Federal Reserve Chairman, from their latest meeting in September, went as far as saying the economic outlook was “remarkably positive.” In Fed-Speak, this is quite, well…remarkable. Fed Chairman usually don’t concede such positivity, but with their forecast of an unemployment rate of below 4% without inflation rising much above the Fed’s 2% target for the next three years, this is a Goldilocks scenario that Fed Governors dream of. Not too hot, not too cold, but just right. This type of low unemployment, low inflation spell hasn’t been witnessed since the 1950’s. Are these projections “too good to be true”?

Some economists find it hard to believe that such sustained low unemployment won’t be accompanied by higher wage growth and therefore higher inflation. A scenario which would challenge the Fed’s current outlook and force them to potentially raise interest rates faster than expected to slow down an “overheating” economy. And one thing we have learned more acutely over the past 20 years, is how incorrect the Fed’s own projections can be at times. Some believe these projections have led to policy errors that can inflate asset prices well beyond their intrinsic value, think bubbles, which inevitably deflate and leave a trail of carnage in their wake. Make no mistake, the Fed knows this history and how uncertain their forecasts are as well, and always speak to the need to adjust as the data dictates. That being acknowledged, one would be hard-pressed to describe the current economy as “overheating.” The year-over-year change in GDP was 2.9% in the second quarter, just a shade over the average of 2.7% going back to the late 60’s. It is however an acceleration from the average of this current expansion of 2.3%. Will the “just right” scenario continue? The Fed seems to think so, which means that they can continue to raise interest rates but in a measured way. With short-term rates between 2-2.25%, most believe that they will raise rates by another 1% over the next year. The simple conclusion from the macro-economic backdrop – still a thumbs-up for now.

Market Elation, Portfolio Stagnation. What Gives?

Along with the supportive economic backdrop, corporate earnings growth has been incredibly strong as well. After strong growth in 2017, the year-over-year growth for 2018 has been 27% for the first two quarters of the year. There is no doubt that the corporate tax cuts played a huge role in this growth, and future year comparisons will not have this same benefit. As we harped upon last quarter, markets do tend to discount the future, so if this is good as it gets, markets may not respond so favorably. But the earnings growth has been a function of both revenue growth and expansion in profit margins, with a boost from share buybacks.

Given the positive economic and earnings environment, the US stock market had a very strong third quarter following a ho-hum first half of the year. The S&P 500 index delivered a return of 7.74%, its best quarter in 5 years, and the year-to-date return as of September 30th was 10.56%. Of course, this is good news. But, there has been a disconnect for diversified investors.

While the “market” as narrowly defined by the US stock market is doing quite well, the “markets” as more broadly defined by all of the asset classes that we believe investors should include in a portfolio, are doing much less well. In fact, the US stock market is effectively the only asset class that is making money so far in 2018. Let’s take a look at the year-to-date numbers:

US Stocks (S&P 500)

+10.56%

Developed International Stocks (MSCI EAFE)

-1.43%

Emerging Markets Stocks (MSCI EM)

-9.54%

High Quality US Bonds (Barclays Aggregate US Bond)

-1.60%

As a result, diversified portfolio returns are much lower than US stock market returns this year, making the results feel less satisfying than we all might expect from watching the news and reading the financial headlines. Any amount of allocation to these other investments this year, will lower returns relative to the US stock market. Does that mean that those allocations were somehow wrong? In our opinion, not at all. It just means that the short-term results can feel unsatisfying relative to the expectation set by the headline return of the “market”. And we recognize that feelings do matter in investing.

Feelings and Investing

Feelings can cause us to want to add more risk when “the market” is doing well, but reduce risk when “the market” is doing poorly. Feelings can cause investors to make decisions not based upon their own unique and objective circumstances, but based upon relative factors and comparisons that are much less important. Feelings lead investors to buy high and sell low, when we know we should do the opposite. Most importantly, feelings and the actions that they can cause us to take with our portfolios, have generally proven to lead investors to results that tend to be worse than ignoring them and sticking to the plan. If not entirely natural, normal and understandable as human beings, feelings can be quite damaging to the long-term success of an investment strategy, and in turn, the effectiveness of a financial plan.

As advisors, and investors ourselves, we have great empathy for these feelings during times like these. But we also know that handling these feelings is an enormous part of managing a successful financial planning and investment experience. In our current environment, where US stocks have performed incredibly well, our feelings can lead to questions about the value of diversification in general. It can also naturally lead to the following questions:

Why diversify at all?

Why should I invest in Bonds?

Why should I invest in International Stocks?

So we’re going to address these questions one by one, to reiterate why we believe that diversification is the right approach in spite of what our guts may be feeling this year.

Why Diversify? You Never Know What Is Going to Prevail

In the financial world, there’s a saying about diversification that goes, “Diversification means always having to say you’re sorry.” The translation is that diversification will mean there’s something in the portfolio that will not be doing well, at nearly all times. We believe it’s the right thing to do, but can often feel difficult. This feeling is particularly acute when US stocks (our market) is doing so well as compared to everything else. But diversification can be very valuable. It’s often called the only “free lunch” for investors. It allows an investor to potentially achieve a higher rate of return for taking a specific amount of investment risk, or less risk for achieving the same rate of return as you can get for an asset class on its own.

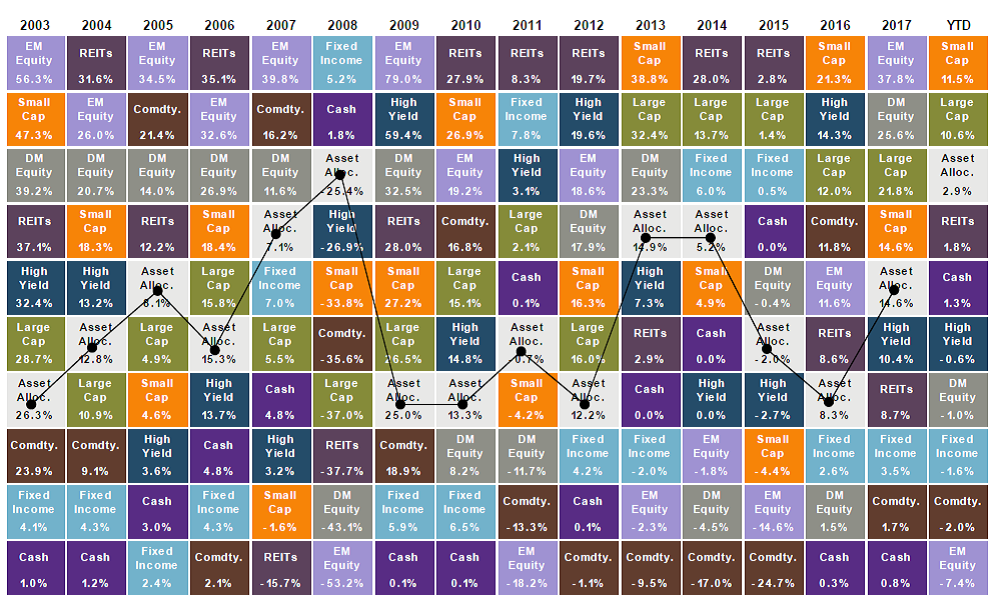

We believe diversification also prevents an investor from having to be “correct” about their investments. From year to year, it is nearly impossible to consistently predict what will do well and what won’t. By diversifying, you don’t need to. The chart above is one of our favorites, often called the “periodic table” of investing. It simply looks at the returns of 9 different asset classes, year-after-year, and going back to 2003. It also includes an asset allocation portfolio of 55% in global stocks, 35% in bonds, 5% in Real Estate (REITs) and 5% Commodities. There are two primary conclusions that we think are important.

First, you will notice how often the leaders and laggards change. In the first 5-years, international and emerging market stocks along with REITs and commodities lead the pack. In the crisis year of 2008, fixed income and cash outperform while stocks drop. Then REITs recover and US stocks start to pull ahead, while commodities and internationals stocks struggle. You never know what will prevail, but you don’t need to if you’re diversified.

Most importantly, you’ll observe that the asset allocation portfolio, connected by the black line, is never the best performer, but also never the worst. Which is exactly the point. Diversification generally provides more consistency, without the need for harmfully trying to profit from prediction - which often ends in tears. Stay diversified, stay consistent, stick to your plan. While diversification may feel less satisfying, we believe it’s a key ingredient for those with a plan.

Why Bonds? They Keep You in the Game

2018 has not been kind to the bond market and the negative headlines have been hot and heavy. How about this one from Bloomberg. “Bonds in $916 Billion Wipeout Spark Fear of Worst Run Since 1976”. Yikes! That sounds terrible. And indeed, it has been a bad year for bonds as interest rates have increased dramatically, driving bond prices lower. But let’s place this headline in perspective for a second. The inception date of the Barclays US Aggregate Bond Index was 1976. Since then, the index has had only 3-calendar years in the past 42 where the return of the index was negative: 1994: -2.9%, 2013: -2.0%, 1999: -0.8%.

As of this writing, the index is down -2.53%. If rates continue to go up, there is a strong likelihood that this will be the worst year for bonds since 1976. But please keep in mind that the magnitude of that “worst loss ever” is quite low as compared to other risker asset classes like stocks. We do not mean to minimize the rough year for bonds, but the nasty headlines that can accompany such bond market “carnage” rarely provide any perspective of how shallow those losses actually are.

With that being said, many portfolios, particularly those of near-retirees and retirees who need to live off of their portfolios, very appropriately may have bond allocations that are north of 50-60%. In a year where bonds have had a tough go of it while US stocks are doing so well, it can make one question the value of bonds in a portfolio. In our opinion, bonds are valuable as an income-provider and shock absorber against the stock market. Most importantly, we believe bonds are valuable because they keep investors “in the game” during the exact times when we humans are most likely to get spooked and abandon our strategy.

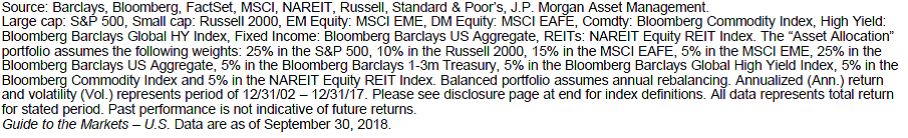

In the chart above, we take a look at what happened to the stock market from its peak in October 2007 and the ensuing 10-years. We compare the S&P 500 index to two blended portfolios of stocks and bonds (Barclays Aggregate US Bond), one that includes 40% in bonds and one that includes 60% in bonds. Given the magnitude of the stock market losses from late 2007 to early 2009, we can observe the impact of bonds on the portfolio from a starting point of $100,000. The stock portfolio, invested solely in the S&P 500, lost over $50,000 or 50% of its value. The stock portfolio, if you held on the entire time, recovered its dollar value nearly 3-years after the market bottomed in 2009. The portfolio with 40% bonds, still endured serious losses, but did not go down nearly as much and fully recovered its dollar value in October of 2010 or approximately 1.5 years ahead of the stock-only portfolio. Finally, the portfolio with 60% bonds had a much more modest loss and was therefore able to fully recover its value in November of 2009 or just 8-months after the stock market bottom. Interestingly, the stock market didn’t catch back up to the blended portfolios until 2014 and really did not begin to surpass the diversified portfolios until 2016.

We fully recognize that this is an extreme example from the very top of the market ahead of one of the worst market crashes we’ve seen. But it’s at these extreme moments as investors where we can tend to make our biggest emotional errors. We believe the takeaway from the chart above is that the diversified portfolios, with stocks and bonds, would have given investors a better chance of staying invested and sticking to their long-term strategy. In this scenario, it would have helped the investor recover more quickly as well. Bonds can provide income and stability, but as importantly, they may reduce the impact of fear at the moments where it’s most needed.

Why International Stocks? They Trade Leadership with US Stocks (and Represent Nearly Half the Opportunity Set)

The US stock market has dominated the international competition over the last 10-years. Since September of 2008, the S&P 500 Index of US stocks has outperformed both Developed International and Emerging Market stocks by an average of approximately 6% per year. That differential is quite large and can lead investors to ask why they would need international stocks in their portfolio at all. We think that investors should include international stocks at all times. First, international companies represent approximately half of the value of the global stock market opportunity set. There have been and always will be great companies to invest in outside of our borders, so excluding them would be to exclude many of the current and future great global companies in the world.

The more empirical argument for including international stocks in a portfolio is that they can produce long-term returns that are similar to US stocks over time, but do so when US stocks may not be doing as well. Over the past 15-years, the US market delivered a return of 9.9% while the rest of the world delivered a comparable return of 9.2%. Not much difference. Importantly, US and overseas stocks tend to trade leadership position over time, which can be very valuable to long-term portfolio results. The reason for this is these markets are not perfectly correlated, meaning that don’t move in the same direction in the same magnitude at the same time. Imperfect correlations can be powerful.

“Recency” bias may also lead us to believe that the US always does better, but the US market was actually one of the worst performing stock markets in the 1970’s and the first decade of the 2000’s. The US also underperformed the international markets in the 1980’s. While it’s not possible to predict when performance leadership may change again, we know that it likely will. Long-term outperformance of one market relative to another, tends to sow the seeds of future underperformance as one market becomes much more expensive relative to others. When the US market ceases its recent dominance, we believe that the international diversification should prove helpful, just as it has many times in the past.

The Key Takeaway

The US economy and corporate earnings have continued their strong performance in 2018. With that, the US stock market turned in a strong quarter of performance as well. However, diversified portfolios that include other asset classes such as bonds and international stocks, have delivered much lower rates of return this year. Portfolio returns as compared to the US stock market can feel unfulfilling during periods like this year, when “our market” is doing well. These feelings can often lead investors to want to deviate from their plans, and question the value of diversification as well as the role of bonds and international stocks in a portfolio. We believe this would be a mistake. These out of favor investments now often will come back into favor, when the “market” as defined by US stocks struggles. The aim of diversification is to prevent the need for prediction. Bonds may keep investors in the game, particularly during periods of stock market distress. And international stocks cycle in their performance leadership with US stocks over time.

Given these dynamics, we will resist the urge to sell low and buy high by performance-chasing into more US stocks. In fact, in the coming months, we will look to do the opposite. As is often said, investing is simple, but it’s not easy. It’s not easy because during times like these, where portfolio results can be frustrating, it can lead investors to do what feels comforting but is often misguided. Given our internal investment discipline and our knowledge of your financial plans, and, we’ll resist that urge in favor of what we believe is best for the long-term financial outcomes that are important to you.