Big Picture and Key Takeaway

4th Quarter 2023

(Click here for printable PDF)

Key Takeaway

The global stock market rally resumed robustly in the 4th quarter after a pause in the 3rd quarter, as the Federal Reserve sent a strong signal that it was done with its cycle of raising interest rates. For the quarter, U.S. Large cap stocks increased (S&P 500 +11.7%) along with developed international stocks (MSCI EAFE +10.4%), finishing the year up 26% and 18%, respectively. However, as was the case during most of the year, the S&P’s gains can be attributed to about half a dozen stocks, and when removed, the S&P gained 12% for the year. After languishing for much of the first ten months, the broad-based bond market (AGG +6.8%) had an exceedingly strong quarter to finish the year, gaining 5.5%, as bond interest rates declined sharply across the maturity spectrum. After an "everything" sell-off in 2022, where both stocks and bonds declined by double digits (S&P 500 -18% & AGG -13%), which has never occurred in history, 2023 responded with an "everything" rally as both stocks and bonds rebounded vigorously.

The catalyst for the "everything" rally, particularly the incredibly strong final quarter of the year, was the Federal Reserve foreshadowing the end of interest rate increases due to the downward trend in inflation coupled with resilient economic growth. The Fed is now forecasting that it can begin to lower interest rates in 2024, although the timing and magnitude will depend highly on economic data and other factors early in the year. While almost no economic forecasters and market prognosticators predicted the positive economic and market outcome in 2023, that positive momentum seems poised to continue into the new year. Given the Fed’s latest projections, the economic "soft landing" outcome, where inflation moderates to the Fed's preferred 2% level while the economy continues to grow, is basically the Fed's and the market's assumed outcome.

Although this economic “Goldilocks” outcome has rarely occurred in history, market participants seem to be positioning themselves for the “soft landing” to come to fruition. In the process, markets seem to be leaving little room for disappointment should this projected outcome deviate from its course with either economic growth slowing towards a recession - or, on the opposite end of the spectrum – the Fed cutting rates only to reignite inflation again. As always, there are other exogenous risks to consider heading into 2024, most notably, elevated geopolitical tensions and its potential disruption on the global economy, as well as the impact of global elections. However, the most significant risk may be that the markets have anticipated the best-case scenario as the most likely outcome. Anything less than this desired and near-perfect outcome may prove disappointing and will likely lead to a volatile year for investors in 2024.

The Big Picture

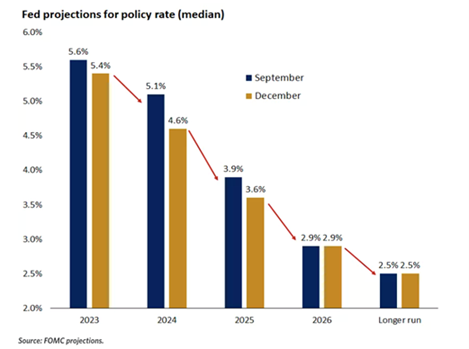

The economic data remained resilient during the 4th quarter due to a strong job market while inflation continued to trend lower. With economic growth remaining in clear positive territory, hope for the typically elusive economic soft landing continues to rise. These hopes have allowed the Fed to significantly shift its projection for the Fed Funds rate in 2024 over the last few months. The chart (below) illustrates where the Federal Reserve projected the Federal Funds rate to end the year in 2023-2026 and beyond after their September and December 2023 meetings. At the September meeting, the median Federal Fund Rates projection for year-end 2024 was 5.1%, implying that they only expected to cut rates approximately once in 2024. At the December meeting, the median Federal Fund Rates projection for year-end 2024 was 4.6%, implying that they expected to cut rates approximately three times in 2024, a significant difference from September. The forecast helped catalyze a strong rally for stocks and bonds to finish the year.

INFLATION: In December, the Bureau of Labor Statistics announced the Consumer Price Index for All Urban Consumers (CPI-U) increased by 0.3% from November on a seasonally adjusted basis. Core inflation (all items less food and energy) rose by 0.3% month-over-month. The year-over-year rates were 3.4% and 3.9%, respectively, from 3.1% and 4.0% in November. Headline inflation moved higher as rent prices increased and contributed to more than half of the month-over-month increase in December. However, core inflation continued moving in the right direction, with the year-over-year number below 4% for the first time since May 2021.

GROWTH (Gross Domestic Product): Late in the quarter, the Bureau of Economic Analysis reported that real gross domestic product (GDP) increased at an annual rate of 4.9% in the third quarter of 2023, according to its "third" estimate. In the second quarter, real GDP increased 2.1%, at an annual rate. The real GDP increase reflected increased consumer spending, private inventory investment, exports, state and local government spending, federal government spending, residential fixed investment, and nonresidential fixed investment. For the 4th quarter of 2023, the Atlanta Feds GDPNow model forecasts continued annualized growth at 2.2% as of their latest reading on January 10th, 2024.

JOBS: The December jobs report exceeded expectations as 216,000 jobs were produced, marking the 36th straight month of employment gains. The unemployment rate remained unchanged at 3.7%. Average hourly earnings for workers grew by 0.4% from the previous month and 4.1% from the previous year, likely still too elevated from the Fed's perspective. Overall, job growth slowed in 2023 relative to 2021 and 2022 but was still strong by historical standards and well exceeded most economists' expectations coming into the year.

EARNINGS and ESTIMATES: According to FactSet, as of January 5th, for the fourth quarter of 2023, the S&P 500 is expected to report year-over-year earnings growth of 1.3%, compared to the estimated earnings growth rate of 8.0% on September 30. Analysts expect year-over-year earnings growth of 6.0% for Q1 2024 and 10.6% for Q2 2024. For the calendar year 2024, analysts call for year-over-year earnings growth of 11.8%. From a valuation perspective, the S&P 500 has a forward 12-month Price/Earnings (P/E) ratio of 19.2, which is above the 5-year average (18.9) and above the 10-year average (17.6). So, expectations for corporate earnings are very optimistic for 2024, while stock market valuations, as measured by the forward price/earnings ratio, remain elevated.

RATES AND THE FED: At the December meeting, the Federal Reserve held interest rates steady in the range of 5.25-5.50%, marking the third meeting in a row where rates were unchanged. Notably, the Fed signaled it would likely cut rates three times in 2024. While the move to hold rates level was well-anticipated, the Fed's "dovish" commentary signaling the end of the rate hike cycle and looking forward to future cuts was not anticipated. Fed Chair Jerome Powell indicated that he was pleased with the progress on inflation, but "we need to see more." Updates to the Fed's summary of economic projections suggest that they expect inflation to continue slowing in 2024 and 2025 without having a material impact on economic growth, making an economic "soft landing" their assumed economic outcome, which historically has proven to be difficult.

Market Performance

Global Stocks

For the 4th quarter, all 36 developed markets tracked by MSCI were positive. And of the 40 developing markets tracked by MSCI, 37 were also positive.

- In the U.S., small companies outperformed large ones for the quarter, and growth stocks beat value stocks. The so-called "Magnificent Seven" stocks (Amazon, Apple, Alphabet, Meta, Microsoft, NVIDIA, and Tesla) contributed nearly half of the stock market's overall gain for the entire year.

- 10 of the 11 S&P 500 sectors delivered positive returns.

- The Technology, Consumer Discretionary, and Real Estate sectors performed best for the quarter, while the Financial sector also rebounded nicely as interest rates declined sharply in the last two months.

- The Energy sector was the lone down sector as oil prices decreased in the fourth quarter.

- Developed international market stocks also posted substantial gains in the fourth quarter, aided by a strong rally in the U.S. dollar.

- Emerging Market stocks delivered a positive absolute performance, however; they underperformed relative to U.S. and Developed International stocks for the quarter. Poland, Mexico, and Taiwan led the way, while China delivered another loss – capping off a challenging year for Chinese markets.

Bonds

-

The bond market posted a very strong quarterly return as interest rates declined significantly during the quarter. As a result, the highlights include the following:

- The 10-year Treasury bond yield decreased by 0.69% for the quarter, lifting bond prices through December. Incredibly, the 10-year yield began the year at 3.88%, increased to about 5% in mid-October, only to drop back down to 3.88% by the year's end to complete a volatile "round trip" for yields.

- Treasury Inflation-Protected Securities delivered positive returns, as real interest rates declined, but underperformed other sectors, and inflation expectations also declined throughout the quarter.

- U.S. mortgage-backed securities delivered solid returns relative to other sectors as lower rates may spur refinancing in the mortgage market, which may allow discounted-price mortgages to get paid back at higher prices.

- Credit spreads, a measure of the bond market's default risk, declined significantly for the quarter. In a reversal of a previous trend, the highest credit quality bonds provided higher returns than lower credit quality bonds, which have higher income payments due to their inferior credit quality.

- The Municipal market delivered a positive return and outperformed its taxable bond market counterparts as yields on AAA municipal bonds declined more than equivalent maturity Treasury Bonds.