Big Picture and Key Takeaway

3rd Quarter 2025

(Click Here for Printable PDF)

Key Takeaway

Heading into the final quarter, investors are experiencing mixed signals again. The U.S. stock market reached record highs in the third quarter, driven by corporate earnings, economic growth, and the artificial intelligence industry. However, the labor market has weakened noticeably since early summer, which is raising some concerns about the overall resilience of the economy and the financial health of consumers.

With the technology sector leading the way, U.S. large-cap stocks continued their gains in the third quarter and for the year (S&P 500, QTR +8.1%/YTD +14.8%), furthering the recovery from the tariff-driven lows in April. Concurrently, smaller U.S. companies saw a significant quarterly rally (R2000, QTR +12.4%/YTD +10.4%) due to expectations of a lower interest rate environment and ongoing economic growth. Benefiting from lower valuations and a weakening U.S. dollar, foreign stocks continue to outpace their U.S. counterparts year-to-date, as both developed (MSCI EAFE, QTR +4.8%/YTD +25.1%) and emerging markets (MSCI EM, QTR +10.6%/YTD +27.5%) continued their advances during the quarter. The broad bond market delivered solid gains (QTR +2%/YTD +6.1%), driven by falling interest rates and narrower credit spreads. Gold continued its impressive surge (QTR +16.4%/YTD +44.8%), reaching new record levels above $4,000 per ounce.

In September, the Federal Reserve reduced interest rates by 0.25%, after keeping rates steady for most of the year. While inflation remains persistently above the Fed’s 2% target, the recent rate cut has been characterized as a “risk management” move to address recent labor market weakness, despite the economy continuing to grow and the stock market reaching new highs.

On the fiscal and trade policy front, investors are now contending with an ongoing U.S. government shutdown and a re-emergence of trade tensions with China. On October 1st, the U.S. government entered a shutdown as both parties dug in their heels over funding, with healthcare being a focal point. After a period of relative quiet on the trade front between China and the U.S., tensions have flared due to new restrictions that China placed on the export of its rare earth metals, which then led the White House to threaten an additional 100% tariff on Chinese goods.

In the past few years, investors have witnessed numerous episodes of increased volatility, such as stubborn inflationary pressures, trade wars, Washington policy and the Fed, recession fears, and geopolitical conflicts, to name a few. The current government shutdown, trade tensions, and job market concerns are the latest worries that might unsettle markets in the short term, even if their long-term effects are generally muted. This environment highlights the importance of maintaining diversification and staying focused on the long term.

The Big Picture

The financial markets and economy maintained their positive momentum in the third quarter. Despite cracks in the labor markets and inflation remaining elevated, the key indicators still point to an overall healthy economic and earnings growth trajectory. However, key economic indicators for September, such as the employment and inflation reports, have been delayed due to the ongoing government shutdown.

INFLATION: For August 2025, the Consumer Price Index for All Urban Consumers (CPI-U) rose 0.4% on a seasonally adjusted basis, accelerating from July's 0.2% increase. Over the past 12 months, inflation increased 2.9%, up from 2.7% in July. The core CPI (all items less food and energy) rose 0.3% in August and was up 3.1% year-over-year, unchanged from July but above the Fed’s target. Shelter costs have been the primary driver of recent inflation increases, rising 3.6% over the last year. Food prices also increased by 3.2% from the previous year.

GROWTH (Gross Domestic Product): According to the U.S. Bureau of Economic Analysis, Real Gross Domestic Product (GDP) grew at an annualized rate of 3.8% in the second quarter, rebounding sharply from the first quarter’s 0.6% contraction. The growth reflected stronger consumer spending and business investment, with the latter showing notable strength, especially in intellectual property products. Software investment soared at an annualized rate of 198% in the second quarter, driven by high corporate demand for digital transformation and AI-related capabilities. This marked the strongest increase since the late-1990s technology boom. Looking ahead to the third quarter release, the Federal Reserve Bank of Atlanta's GDPNow forecasting model predicts an annualized growth rate of 3.8%.

JOBS: The August employment report showed unemployment staying low at 4.3%, but job growth has slowed significantly. The economy added just 22,000 payrolls in August, much less than the 123,000 average monthly gains from January to April. June's payroll figure was revised to -13,000, the first negative since 2020. Even more unexpectedly, the annual payroll revisions by the Bureau of Labor Statistics (BLS) reveal that over the 12 months before March, there were 911,000 fewer jobs than initially reported. This revision is large by historical standards, surpassing the 2009 figure of 902,000.

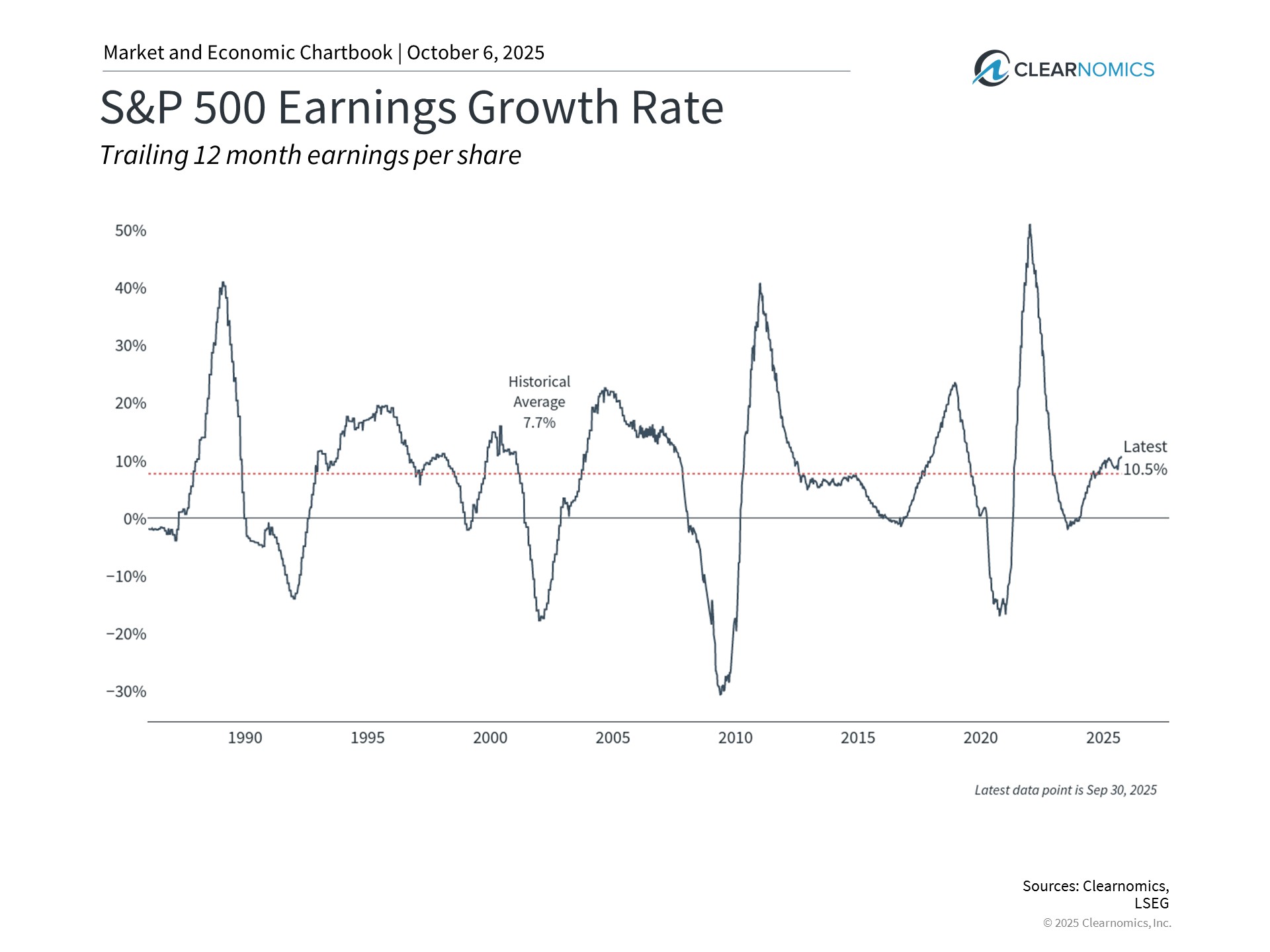

EARNINGS and ESTIMATES: As of September 30th, research firm FactSet reported that for Q2 2025, 79% of S&P 500 companies beat analyst estimates for revenues in the second quarter, while over 80% exceeded earnings expectations. These figures are well above the longer-run averages of around 60%. With trailing 12-month corporate earnings growing by 10.5% in Q2 (see chart), this marked the third consecutive quarter of double-digit earnings growth. For Q3 2025, the estimated earnings growth rate stood at 7.9%. The forward 12-month P/E ratio for the S&P 500 was 22.5, above the 5-year average of 19.9 and the 10-year average of 18.5, reflecting continued investor confidence in future earnings growth despite elevated valuations.

RATES AND THE FED: At its September meeting, the Federal Reserve lowered rates by 0.25% to a range of 4% to 4.25%. According to the latest FOMC statement, the Fed highlighted that it cut rates because "uncertainty about the economic outlook remains elevated" and "downside risks to employment have risen." Chair Jerome Powell, in his post-meeting press conference, described the cut as a "risk management" decision rather than an emergency response, emphasizing the Fed's data-dependent approach. Looking ahead, the trend toward lower short-term interest rates is likely to persist. Market expectations, based on Fed funds futures, indicate that the Fed may lower rates again at its October and December meetings, before slowing the pace of monetary easing in 2026.

Market Returns

Global Stocks

Global equity markets delivered broadly positive returns in the third quarter, with developed and emerging markets alike benefiting from expectations of monetary easing among major central banks.

In the U.S., small companies outperformed large companies for the quarter, and growth stocks beat value stocks.

Ten of the eleven S&P 500 sectors delivered positive returns, demonstrating broad-based market strength as rate cut expectations took hold.

Technology sectors continued their dominance, with Information Technology and Communication Services both posting double-digit gains.

Energy was the sole negative performer, declining 2.3% as crude oil prices weakened on supply concerns and moderating global demand

International investors found opportunities across nearly all major regions, as the weakening U.S. dollar and improving earnings growth outside the United States provided tailwinds for non-U.S. equities. Regional performance varied, with Asian markets benefiting from resilient demand trends and European markets supported by renewed commitments to fiscal expansion, particularly in defense spending.

Emerging markets particularly distinguished themselves, outpacing developed market returns as investors rotated toward higher-growth opportunities. China was a standout performer along with Latin American markets such as Colombia and Peru. India, however, struggled with a negative return in the third quarter.

Bonds

The bond market posted a positive quarterly return as interest rates on bonds declined. The highlights include:

The 10-year Treasury bond yield declined by 0.08% for the quarter, leading to a positive return in U.S. Treasuries from the income produced during the quarter.

Treasury Inflation-Protected Securities increased and outperformed standard Treasuries as inflation expectations increased modestly from the end of June.

U.S. mortgage-backed and asset-backed securities performed in line with most other fixed-income sectors as their high credit quality and attractive valuations remain attractive to fixed-income investors.

Credit spreads, a measure of the bond market's default risk, decreased for the quarter. The highest credit quality bonds outperformed relative to lower credit quality bonds, the latter of which have higher income payments due to their inferior credit quality.

The Municipal market outperformed its taxable bond market counterparts, as yields on municipal bonds declined by a larger amount than equivalent-maturity Treasury Bonds.

Important Disclosure Information

This report is provided as information and commentary regarding the market. The views expressed in this report are as of the date of the report, and are subject to change based on market and other conditions. This report contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

Please note that nothing in this report post should be construed as an offer to sell or the solicitation of an offer to purchase an interest in any security or separate account. Nothing is intended to be, and you should not consider anything to be, investment, accounting, tax or legal advice. If you would like investment, accounting, tax or legal advice, you should consult with your own financial advisors, accountants, or attorneys regarding your individual circumstances and needs. Advice may only be provided by AtwoB after entering into an investment advisory or financial planning agreement. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment and/or planning advice from AtwoB. If you are an AtwoB client, please remember to contact AtwoB, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services.

Past performance is not a guarantee of future returns. Investing involves risk and possible loss of principal capital. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by AtwoB, or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of any fees or expenses, transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices and/or categories.

AtwoB is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the AtwoB's current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request.

Index and Category Definitions

The S&P 500 Index is a capitalization-weighted index of 500 U.S. stocks. Russell 2000 TR USD is a market cap weighted index The Russell 2000 measuring the performance of approximately 2,000 smallest-cap American companies The MSCI All Country World ex-USA Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI All Country World ex-USA Index consists of 22 developed and 24 emerging market country indices. The MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada. The MSCI Emerging Markets (E.M.) Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of 24 emerging markets countries. Bloomberg Barclays U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds. ICE BofAML U.S. High Yield Index is an unmanaged index of below-investment grade U.S. corporate bonds. XZU Gold Spot $/Oz reflects the exchange rate of Gold against the U.S. dollar index.