F.I.T. Focus - To Refi or Not Refi

January 2020

With interest rates at historically low levels, many people are considering refinancing their current mortgage. Refinancing a mortgage to a lower rate can be beneficial in many circumstances, but there are no simple "rules of thumb" to determine whether it makes sense to go through the process. Instead, it is best to evaluate the options with your specific situation and financial objectives in mind. In general, the purpose of mortgage refinancing falls into a few categories:

- Reduction of the overall mortgage payment

- Reduction of overall interest paid

- Reduction of the overall term of the mortgage

- Convert to a fixed interest rate from an adjustable interest rate

- A combination of the above

To meet these objectives, most homeowners with 30-year fixed-rate mortgages generally have the following three options, listed with their potential pros and cons:

1. Refinance into a New 30-year Mortgage

Pros – Likely the Lowest Payment Option

Cons – Extending Mortgage Term Leads to Longer Time to Payoff Loan, and Potentially More Overall Interest Paid

2. Refinance into a New 30-year mortgage and Prepay Principal

Pros – Likely a Lower Payment, and Can Engineer a Similar or Shorter Loan Term than Original Loan, Less Overall Interest Paid, Flexibility to Cease Pre-Payment if Needed

Cons – Homeowner May Not Maintain Discipline to Prepay

3. Refinance into a New 15-year Mortgage

Pros – Quicker Path to eliminating a mortgage, Potentially Much Less Overall Interest Paid

Cons – Higher Monthly Payment is Likely

While these options are not exhaustive, they represent the most standard options available. So, let's explore a quick example to illustrate the potential benefits and drawbacks of each.

An Example of Refinancing Options

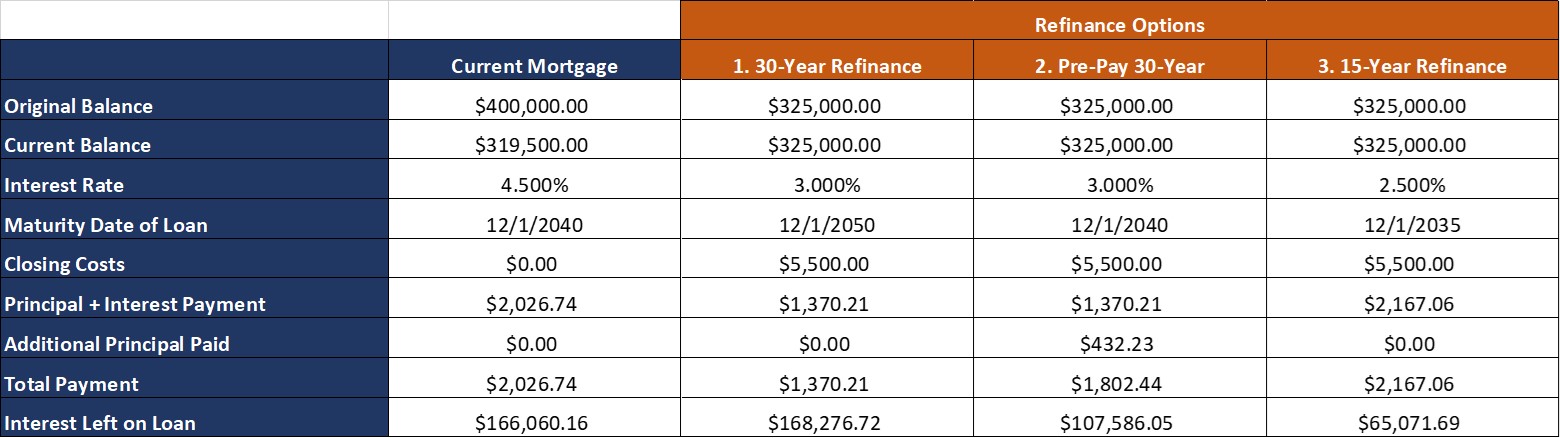

Sally and Harry purchased their home for $500,000 ten years ago with a $100,000 down payment and a $400,000 mortgage. Their current mortgage is a 30-year loan, has a fixed interest rate of 4.5%, with a balance remaining of around $319,500. Current fixed rates on a 30 and 15-year mortgage are 3% and 2.5%, respectively. Closing costs on a new refinancing would be about $5,500, which they decided they would roll into the new loan. The results are as follows:

*The above example is hypothetical, and factors, including but not limited to, employment, credit, home value, closing costs, and cash out impact calculations.

Option 1 – 30-Year Refinance: If Sally and Harry were to refinance to a new 30-year loan, their payment would drop from $2,027 to $1,370. While the payment is lower, they will have to pay their loan for an extra ten years as the maturity date has shifted from December 2040 to December 2050. Additionally, the estimated interest remaining on the loan would be more than if they did not refinance.

Option 2 - 30-Year Refinance, Prepay Enough to Pay Off Loan on Current Schedule: If they refinance into the new 30-year loan and pay an extra $432 per month on the principal, they will pay off the loan in 20 years at their original payoff date. Their total payment, including the additional principal, would be $1,802, or about $225 lower than their current amount. Overall, they would also pay approximately $58,000 less in interest over the loan's remaining life.

Option 3 – 15-Year Refinance: If they refinance into a 15-year mortgage, their payment will increase by approximately $141 (from $2,026 to $2,167). While their payment increases, they will pay off the mortgage 5 years faster and save over $100,000 in interest.

Conclusion

Whether your objective is to obtain the lowest possible payment, a much shorter term to own your home sooner, or something else, your specific circumstances should drive your decision. With mortgage rates still hovering around historical lows, it likely makes sense to review your options today.

If you have any questions regarding this report, please contact us at info@atwob.com or 914.302.3233

Point B Planning, LLC d/b/a AtwoB | 23 Parkway, 2nd Floor Katonah, NY 10536 | www.atwob.com

Important Disclosure Information

Important Risks: Investing involves risk, including the possible loss of principal. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is not a guarantee of future results. Indices are unmanaged and not available for direct investment.

This information should not be considered investment advice or a recommendation to buy/sell any security. In addition, it does not take into account the specific investment objectives, tax, and financial condition of any specific person. This information has been prepared from sources believed reliable but the accuracy and completeness of the information cannot be guaranteed.

This material and/or its contents are current at the time of writing and are subject to change without notice. This material may not be copied, photocopied or duplicated in any form or distributed in whole or in part, for any purpose, without the express written consent of Hartford Funds Distributors, LLC.

The views expressed in this report are as of the date of the report, and are subject to change based on market and other conditions. This report contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

Past performance is not a guarantee of future returns. Investing involves risk and possible loss of principal capital. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by AtwoB, or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of any fees or expenses, transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices and/or categories.

Please note that nothing in this report post should be construed as an offer to sell or the solicitation of an offer to purchase an interest in any security or separate account. Nothing is intended to be, and you should not consider anything to be, investment, accounting, tax or legal advice. If you would like investment, accounting, tax or legal advice, you should consult with your own financial advisors, accountants, or attorneys regarding your individual circumstances and needs. Advice may only be provided by AtwoB after entering into an advisory agreement. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from AtwoB. If you are an AtwoB client, please remember to contact AtwoB, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services. AtwoB is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the AtwoB’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request.